MAKING SUSTAINABLE DECISIONS

We’re decarbonising our portfolio and enhancing climate resilience to create places where people, businesses and nature flourish.

Our 2030 commitments

TAKING ACTION

Since we set our targets and launched our strategy in 2020, we’ve made great progress.

With real estate accounting for around 21% of global greenhouse gas emissions, all of us working in the industry have a responsibility to support the transition to a low-carbon economy.

In taking action, we’ve reduced embodied carbon in our new developments and the carbon intensity of our operations.

We’ve also lowered water use at our places and are reusing, composting and recycling more, while delivering new projects creating places that encourage biodiversity.

This work is reflected in our 5-star rating in GRESB's annual sustainability assessment for both Standing Investments and Development – identified as European Sector Leader for Standing Investments and Global Sector Leader for Development.

reduction in embodied carbon intensity across our office developments, versus 2019 industry benchmarks at 615kg CO2e/sqm

improvement in whole building operational energy intensity, versus 2019

GRESB Real Estate Assessment for Standing Investments and Development

Key Downloads

Sustainability ReportingFOCUSING OUR EFFORTS

Our Greener Spaces commitments cover a number of focus areas that are most material to our work – from decarbonising our portfolio and growing climate resilience to boosting biodiversity, rethinking waste and saving water. Together, these help us make an impact as efficiently and effectively as possible.

You can find more detail on our performance in our Sustainability Reporting.

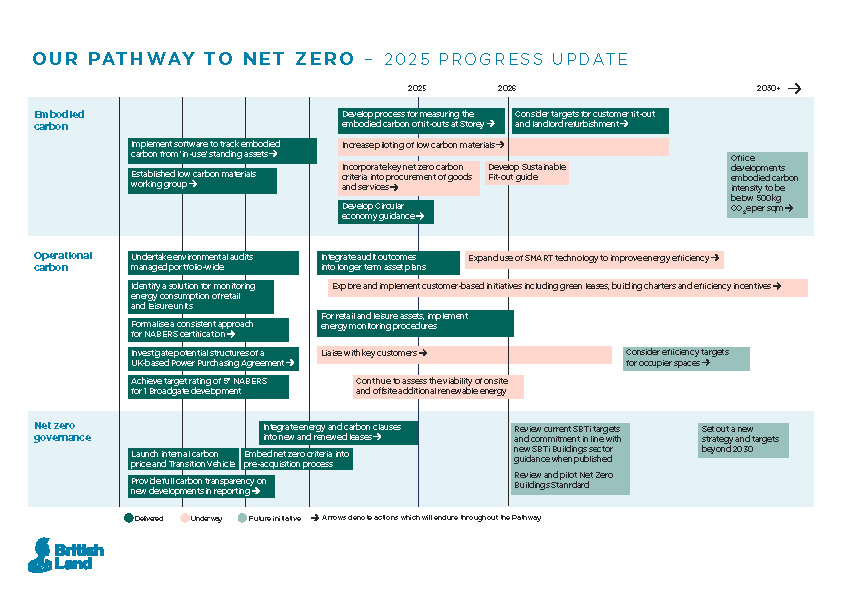

Decarbonisation

Our decarbonisation work reduces both embodied and operational carbon. Embodied carbon encompasses all the emissions from creating, maintaining and eventually deconstructing our buildings. Operational carbon covers all the emissions from running our buildings, including energy for heating, cooling and lighting. To cut embodied carbon, we’re reusing and recycling as much as possible, designing lean and using low carbon materials. To improve operational efficiency, we're retrofitting heat pumps in our buildings, installing responsive LED lights and investing in the latest technology developments, including renewables. Our Transition Vehicle finances energy efficiency retrofitting projects across our standing portfolio and carbon credits to offset residual embodied carbon in our developments. Established in 2020, it is funded by our internal carbon levy, which is currently £90 per tonne on embodied carbon in developments, and an additional £5m annual float.

Our decarbonisation work reduces both embodied and operational carbon. Embodied carbon encompasses all the emissions from creating, maintaining and eventually deconstructing our buildings. Operational carbon covers all the emissions from running our buildings, including energy for heating, cooling and lighting. To cut embodied carbon, we’re reusing and recycling as much as possible, designing lean and using low carbon materials. To improve operational efficiency, we're retrofitting heat pumps in our buildings, installing responsive LED lights and investing in the latest technology developments, including renewables. Our Transition Vehicle finances energy efficiency retrofitting projects across our standing portfolio and carbon credits to offset residual embodied carbon in our developments. Established in 2020, it is funded by our internal carbon levy, which is currently £90 per tonne on embodied carbon in developments, and an additional £5m annual float.

Nature

We recognise the intrinsic value of nature and the key role it has in supporting the health and wellbeing of customers and visitors to our places. For over a decade we have been supporting nature across our portfolio through the introduction of accessible green spaces.

Climate Resilience

We continue to futureproof our portfolio for climate resilience. Our Climate Resilience Action Plans for our places cover flood risk management, thermal comfort and nature-based strategies as appropriate. Our decarbonisation strategy also futureproofs our portfolio for predicted climate scenarios.

Circular Economy

We aim to eliminate waste by keeping materials in use for as long as possible. This includes prioritising reuse and recycling across all our places and sourcing all construction materials from ethical and sustainable sources. In reducing embodied carbon, our number one priority is to use less – retaining existing building components, reusing materials and focusing on design efficiency.

Water Use

We aim to minimise water use, optimising efficiency and maximising opportunities for rainwater and greywater recycling. Our Sustainability Brief for our Places sets out our targets to reduce water use on new developments and we are developing targets for standing assets.

EPC Ratings

We’re making strong progress in enhancing the energy efficiency of our standing portfolio, with 68% now rated EPC A or B. This is up from 58% at FY24.